At the mercy of the credit card processors - Merchants

At the mercy of the credit card processors - Merchants

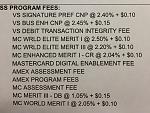

This is why I think Mastercard/Visa/Discover/American Express are the highway bandits of the digital age. This is my statement this month for my credit card processing (cropped so you do not see the actual amount charged on each line item). Twenty-six line-item charges. That's right... 26. Each charge is different based on what kind of card is used by a customer, some cards cost more to process (rewards and business cards) than others. How is a merchant supposed to figure it all out? Short answer is - its impossible. You take what they charge you and run on average percentages per month. What's really amusing to me is the two to three phone calls that come in every single business day where another processor says "We can beat your rate from your current processor, we guarantee it". Oh yeah? How is that? I can't read it - and they can't read it, either.

My favorite line item fees?

"Merchant Compliance Program Fee" $ 9.95 a month : this is to administer to me a true/false test of about 50 questions I answer on the internet. Any FALSE answer is wrong. Any TRUE answer is correct. Brilliant.

"Clearing and Settlement Fee" $ 81.90 a month : This is a fee they charge you to take your money. A bill to collect a bill. Imagine if the phone company charged you $ 5 a month to collect your phone bill...lol

It used to be a flat fee, years ago - a straight percentage of the bill. Now these companies are like gangsters, they add fees that make no sense and the merchants have no say in it. We accept the fees we can't understand or don't accept credit cards - that's the choice. I wish Congress would pass a law requiring the banks an credit card companies to charge a single flat fee, but all laws for these kind of things are consumer based, not business.

The credit card companies have done a marvelous job of pitching use of the cards to everyone, and its the main form of currency now. The merchant (that's me) has to plan on an average percentage and pack it into the retail price of things. When I first started this business 30 years ago, about 5% of sales were in credit cards, now its 90%.

The Keeping Room will always offer you a 2 % discount if you choose to pay via check or wire transfer, or cash. That's on any order, just ask for it if you want it. Some people want the rewards points, others like the cash discount. You can have your choice! Meanwhile, I will continue to be totally frustrated by the way they charge fees...

Duane Collie

Straight answers from thirty-six years in the business.

My Private Messages are Disabled - Please ask questions here in the forum.

Reply With Quote

Reply With Quote